Leveraging lower interest rates for building construction

Recent declines in Canada’s Prime Rate help companies save on financing costs for investing into and growing their business.

Lower interest rates present significant cost saving opportunities for companies financing new construction projects. After fluctuating widely between 2022 and 2024, rates have now returned to pre-Pandemic levels. Businesses across Canada should be closely evaluating their impact with an eye to potential growth and operational expansion. Fortunately, the return to lower rates creates an ideal time to invest at lower costs.

Businesses depend on reliable, cost-effective financing to expand production capabilities, add new equipment, increase storage capacity and enlarge their workforce. Summit Steel Buildings supplies custom-designed industrial

and commercial structures that make new or expanded operating and warehousing spaces affordable. Improved infrastructure can benefit a company in many ways for decades and more working space have been proven to

improve companies’ long-term bottom line.

Read more:

- "The danger of production bottlenecks has a simple solution"

- "The importance of increased working space"

- "Larger working spaces lead to operational savings and human resource gains"

Understanding the economic impact of Canada's interest rate environment

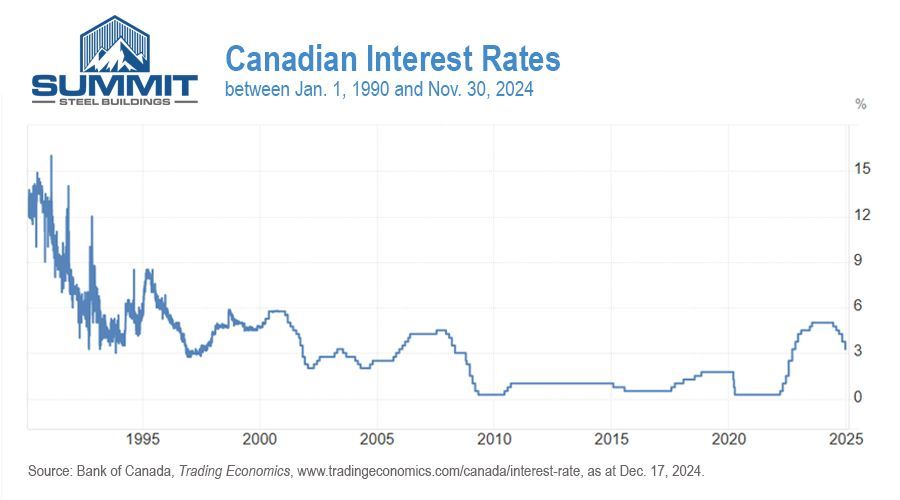

Interest adjustments are one tool of monetary policy the Bank of Canada uses to maintain economic stability or to manage inflation. Other financial institutions follow suit and set their rates as part of the wider strategy to encourage business growth and achieve broader economic goals. Usually, lower rates are preferred because reduced capital financing costs stimulate business activity by reducing borrowing costs for new projects and entrepreneurial endeavours.

The Bank of Canada has taken a more aggressive approach to rate reductions recently compared to the U.S. Federal Reserve, although American rates are projected to decrease steadily as well. These rate reductions have been successful in stimulating economic activity and reducing rising prices that were such a huge problem during the recent inflation crisis between 2021 and 2024.

Canadian interest rates are returning to the lower levels we’ve enjoyed since mid-2009. These favorable rates supported capital investment that helped drive industrial growth and commercial development across North America for almost two decades.

As interest rates decline, businesses with variable-rate loans benefit in several ways:

- Reduced monthly interest payments free up capital for strategic initiatives

- More funds can be directed toward principal reduction

- Faster payoff of expansion-related debt becomes possible

- Overall cost of capital decreases significantly.

Take action to maximize your savings

Lower interest rates aren’t the only way business increase the value of their building investment and lower overall costs. A well-thought-out project plan takes advantage of longer-term supply-side scheduling. Ordering your building earlier into the planning stages allows Summit Steel Buildings to help you capitalize on project scheduling benefits:

- Locking in more competitive building supply prices early

- Guaranteeing construction timelines

- Ensuring supply chain reliability

Contact Summit Steel Buildings today to learn how we can help you take advantage of current interest rates and create a cost-effective construction plan for your business. Our experts will guide you through financing options and demonstrate how building now can benefit your long-term growth strategy.

Schedule a free consultation to explore our complete range of building solutions. For free quote and preliminary drawings suited to your specific location and need, please use our webform, send us an email or call us by telephone at 877-417-8335. We're excited to hear about your business and help develop your ideal pre-engineered building solution.

About the author

Darren Sperling has specialized in the engineering and delivery of pre-engineered steel buildings for over 15 years and has experience in over 20 countries worldwide. He can be contacted at Summit Steel Buildings at (877) 417-8335, by email at darren.sperling@summitsteelbuildings.com or on LinkedIn.