Understanding steel prices

Steel is the biggest material cost in new construction, so it's important to understand how it is priced and the factors that affect it.

Price is a major consideration when undertaking a building project. Whether it’s a matter of lowering total project costs or working within a specific budget, steel is the biggest material cost in a new construction. As a result, the global price of steel is a factor that requires special attention. Understanding the conditions that cause steel prices to rise or decline can help you save considerably when it's time to invest.

The recent pandemic has affected the price of steel dramatically, much like other building materials. The average steel price has risen over 50 per cent since the spring of 2020 and, if analysts are correct, it will continue to climb over the next two years. Inflation is usually considered a bad thing; however, you can benefit from these changing steel prices to save what you pay for your building.

Some price factors you control, others not so much

The price of your steel building is determined by its layout, size, design and the other ways you customize the engineering to fit your precise needs. These are internal factors you can control. But external factors, such as the price of steel, may also significantly affect your final cost. Macroeconomic conditions and the timing of commodity markets play a role in how Summit Steel Buildings prepares its quotes. We create estimates using our suppliers’ current market prices and commit to them regardless of changing market conditions. At present, where steel prices are expected to rise, you’re able to realize significant savings by locking in your building contract while prices are lower.

Steel as a much-needed Canadian commodity

Canada’s economy has historically relied on trade, especially in commodities. From furs, fish and timber to auto parts, steel and finished goods. Imported and exported goods greatly influence our employment, income and, ultimately, inflation. Commodities made up 43 per cent of Canada’s exports, up from 34 per cent in 1999 according to the Bank of Canada.

Commodity prices tend to go through multi-year boom and bust cycles called supercycles. These are extended periods where commodity prices are well above or below their long-term trend and they typically last longer than the business cycle (which averages approximately six years). Unexpected demand drives price supercycles. The upswing phase (as we’ve experienced in the pandemic) results in rising prices due to a lag between persistent and positive shocks to commodity demand and the resulting slow-moving response in supply. Eventually, as supply finally expands and demand subsides, the cycle reverses and prices come down again.

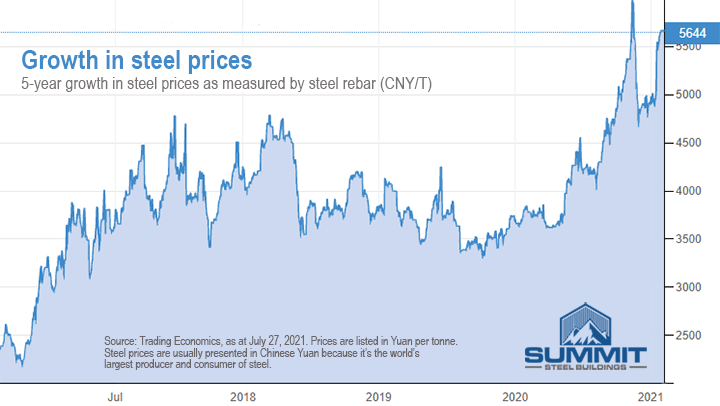

Using steel rebar prices over a five-year period as reference, steel prices have experienced volatility, but none as much as in the last pandemic year. Prices that had dropped during the summer of 2018 and were relatively stable dramatically rose to pandemic-related record highs. Despite a recent short period of respite, prices continue to climb and are expected to stay higher for longer.

According to Gordon Johnson in a July 2021 interview with BNN, aggressive fiscal stimulus and continued high infrastructure spending in both China and the U.S. are driving many commodity prices higher – including steel. Inflation, both as a concern and a response to economic conditions, will have an impact during the next two years at least.

Why are we using the price of steel rebar in Chinese Yuan for comparison?

The price of steel is usually presented in Chinese Yuan because China is the world’s largest producer and consumer of steel. Rebar is the most significantly traded steel product on the Shanghai Futures Exchange and London Metal Exchange with a standard future contract of 10 tons. Steel is one of the world’s most important materials used in construction, cars and appliances. The biggest producers of crude steel are China, followed by European Union, Japan, United States, India, Russia and South Korea.

Future demand and supply shortages

In our current upswing, steel producers in both Canada and China have been holding back inventory to not flood the market with supply so they can help keep prices high. Even as the post-lockdown recovery increases consumer spending, producers will need to expand their capacity to keep up with anticipated increase in demand. That means more warehousing, more manufacturing and more operational facilities. Global steel supply to meet all this development is expected to lag as a result, meaning commodity prices will continue to rise.

Which factors influence the price of steel?

Steel is a global commodity which will experience price fluctuation due to a variety of domestic and global factors. The resulting commodity price becomes the base for manufacturers to calculate their own prices on steel goods used for finished products and as inputs in construction. The most important determining factors are supply and demand. These work in combination with other economic and political conditions.

Primary domestic factors:

- Demand for steel by manufacturers and for their products

- Relative strength of Canadian and American currency

- Manufacturing capacity and labour relations

- Trade tariffs and duties on imports

Primary global factors:

- Mining and production levels

- Health of the world economy

- Diplomacy, politics and war

- Disruption to supply chains (including natural and manmade disasters)

Save thousands by locking in your building price now

When you’re looking to invest in a pre-engineered metal building, the price of steel substantially impacts the final price of your project. The global pandemic has only increased the unpredictability of already volatile steel prices. With prices expected to rise, you can save on your next construction project by buying your building now instead of waiting.

Summit Steel Buildings is a premier pre-engineered steel building supplier. Don’t hesitate to reach out to us to provide you with a quote that will guarantee the price of your next project. Together, we can help protect you against inflation and changing marketing conditions.

About the author

Darren Sperling has specialized in the engineering and delivery of pre-engineered steel buildings for over 15 years and has experience in over 20 countries worldwide. He can be contacted at Summit Steel Buildings at (877) 417-8335

or by email at

darren.sperling@summitsteelbuildings.com.